Biweekly mortgage calculator with extra payments and lump sum

Make sure one thing. Mortgage Amount or current balance.

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

You can do this by making a one-time payment towards the principal balance.

. Make a 13th Loan Payment Each Year. You can make lump-sum payments. Is approaching 400000 and interest rates are hovering around 3.

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term. Check your mortgage contract for the specific amount.

Make more frequent payments. A minimal extra principal payment made along with a regular payment can save the borrower a large amount of interest over a loans life particularly if those payments start when the debt is relatively new. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

This wont change your monthly payment amount. The lender then modifies your amortization schedule to reflect your new balance. A biweekly mortgage payment schedule makes a payment on your mortgage every two weeks instead of once a month.

Mortgage Calculator Excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. Recasting usually charges fees around 200-300. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. Lump-Sum Payments What if you experience a windfall and come into some extra funds.

They receive a lump sum payment upfront for interest that would otherwise trickle-in over time. If the schedule payment for a given period is greater than zero return a smaller of the two values. Fortnightly payments follow the 52-week calendar year instead of the 12-month.

For this reason you can think of points offered as a reflection of the overall strength of current market conditions. Mortgage Calculator zip file - download the zip file extract it and install it on your computer. Extra Payments In The Middle of The Loan Term.

NerdWallets early mortgage payoff calculator figures out how much more to pay. But if you have large funds you can use it to decrease a considerable portion of your loan. Whatever the frequency your future self will thank you.

Make a lump-sum payment. If paying your mortgage loan off sooner is your goal perhaps a lump-sum payment is the right option to pursue. You can use your current lender to switch to biweekly payments or create a schedule yourself.

Recasting your mortgage is an excellent way to lower your monthly payment while keeping your interest rate and avoiding the fees that come with refinancing. You can make a lump-sum payment on top of your regular mortgage payments. There are two primary strategies for making extra payments on your mortgage.

This mortgage calculator gives a detailed breakdown of up to two mortgages and calculates payment schedules over your full amortization. This is the best option if you plan on using the calculator many times over the. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator.

Besides extra monthly payments there are other payment strategies you can adapt to reduce your mortgage term. Pay off your mortgage early by adding extra to your monthly payments. If the borrower starts making the extra payments early enough and for an amount thats not exceptionally large it is possible to save tens of thousands of dollars on a 200000 mortgage the average size new mortgage balance as of 2017 according to the Consumer Financial Protection Bureau was 260386.

These include making lump sum payments or shifting to a biweekly payment schedule while making additional payments. In a year you might receive lump sum payments in the form of an annual work bonus or a windfall from a business venture. IFERRORB10C10 Principal E10.

Make Lump Sum Loan Payments. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. Simply add the scheduled payment B10 and the extra payment C10 for the current period.

You may only be able to put a limited amount of money toward your mortgage. The mortgage calculator spreadsheet has a mortgage amortization schedule that is printable and exportable to excel and pdf. According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US.

The accelerated payment calculator will calculate the effect of making extra principal payments. Well compare a regular mortgage payment with a lump sum 13th payment done once a year. The example presumes your mortgage rate remains at 3 APR.

The loan is secured on the borrowers property through a process. The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much. Here are the advantages of making extra mortgage payments.

Viewing Your Results Once you have filled out all your information click on the calculate button to see the side-by-side results for your old loan and the loan with extra payments made. For example if you are 35 years into a 30-year home loan you would set the loan term to 265. With biweekly mortgage payments you make a payment toward your.

Balloon loan schedule with interest only payments and a lump sum extra payment. If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. Before the end of your term.

At the end of your term. It involves paying a lump sum toward the principal amount. Points have an obvious financial benefit to the lender.

At certain times during your term. Your bi-weekly or extra payments if you make are applied to your account with immediate effect. Biweekly Mortgage Calculator with Extra Payments.

In that case set the number of extra payments to Unknown When the extra payments are off-schedule the calculator prepares an expanded amortization schedule showing the payment being applied 100 to the principal with interest accruing. This is commonly known as a biweekly payment plan. Help with Amortization and Extra Payments.

Here are different payment methods you can try. Total Payment D10. We also generate graphs summaries of balances payments and interest over the life of your mortgage.

You could add 360 extra one-type payments or you could do an extra monthly payment of 50 for 25 years and then an extra monthly payment of 100 for 3 years etc. You may also enter extra lump sum and pre-payment amounts. This is the best option if you are in a rush andor only plan on using the calculator today.

Mortgage Calculator with Lump Sums. Recurring extra payments add up to reduce your principal balance. Scheduled payment minus interest B10-F10 or the remaining balance G9.

Make sure you look for mortgage scams and check with your lender to make sure it supports biweekly payments and credits you appropriately. Mortgage calculator with extra payments and lump sum Excel Template Excel amortization schedule with irregular payments Free Template Mortgage payoff calculator with extra principal payment Excel.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Biweekly Mortgage Calculator How Much Will You Save

Extra Payment Calculator Is It The Right Thing To Do

Mortgage With Extra Payments Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Printable Bi Weekly Amortization Tables

Biweekly Mortgage Payments An Easy Trick To Do Them For Free

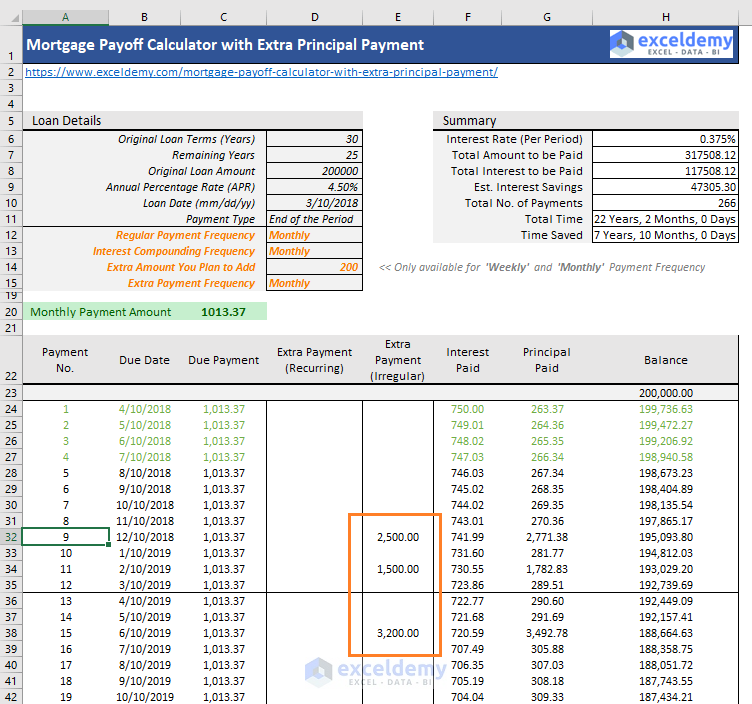

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Extra Payment Mortgage Calculator For Excel

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Extra Payment Calculator Is It The Right Thing To Do

Mortgage Payoff Calculator With Extra Payment Free Excel Template

Mortgage Calculator With Extra Payments Payment Schedule

Mortgage Payoff Calculator With Extra Principal Payment Free Template